Accounting just got a whole lot quicker and easier. AI-powered tools can now handle most things from fraud detection to expense auditing, freeing finance teams to focus on strategy instead of spreadsheets.

Here are the top 6 in 2025.

Feature comparison table

| Tool | Primary Focus | Data Sources | Starting Price | AI Functionality | Automation Level | Security Features |

| Coefficient AI | Spreadsheet Enhancement | 70+ business systems | Free trial available | GPT-powered formulas & analysis | Real-time data sync, automated reports | Enterprise-grade |

| MindBridge AI | Risk & Fraud Detection | Financial datasets | Custom pricing | Ensemble AI, unsupervised ML | 100% transaction monitoring | Advanced compliance |

| AppZen | Expense Auditing | Expense management platforms | $5,000/month | Real-time audit AI | Automated approvals | FCPA compliance |

| DataSnipper | Audit Automation | Excel-based documents | Freemium model | GenAI document analysis | Workflow standardization | Audit-grade security |

| Botsify | Customer Interaction | Multi-platform chatbots | $49/month | Conversational AI | Lead generation automation | Standard encryption |

| Gridlex | Comprehensive ERP | Integrated business data | $10/user/month | AI-driven insights | Full accounting automation | Cloud-based security |

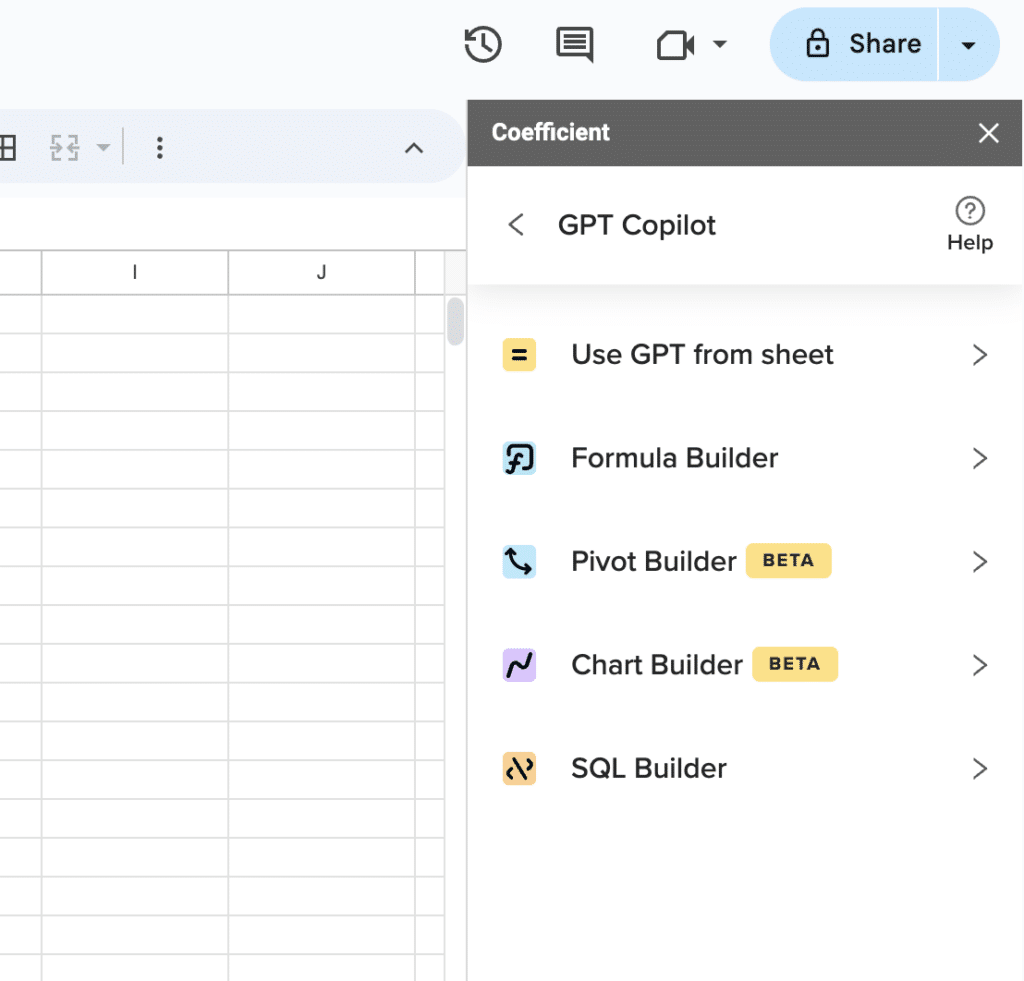

Coefficient AI

Coefficient AI transforms Google Sheets into a command center. Connect live data from Salesforce, Shopify, and 100+ business systems. Ask questions in plain English. Watch as dashboards, pivots, and reports build themselves automatically.

Highlights of Coefficient AI

Live data connections keep your spreadsheets updated in real-time from Salesforce, Shopify, Snowflake, and dozens of other platforms. GPT-powered formulas clean, query, and enrich data using simple text instructions—no coding required.

Pros

Zero learning curve: Works directly in Google Sheets, so your team starts being productive immediately. No new software to learn or complex onboarding processes.

Lightning-fast reporting: Build custom dashboards and reports from multiple data sources in minutes, not hours. The AI assistant handles pivot tables, charts, and conditional formatting automatically.

Smart alerts: Get instant Slack or email notifications when key metrics change in your spreadsheets. Never miss important financial thresholds again.

Cons

Spreadsheet limitations: Advanced analytics are constrained by Google Sheets’ native capabilities. Complex statistical analysis may require additional tools.

Template dependency: Heavy reliance on pre-built dashboards can limit customization for unique analytical needs. Power users might find themselves wanting more flexibility.

Pricing

As of August 2025, Coefficient offers a free trial with tiered pricing based on connectors and features. Enterprise plans available with custom pricing.

What do users say about Coefficient AI?

Positive Review: “Coefficient makes spreadsheet work ridiculously easier, allowing automated real-time data pulls from Salesforce—plus, the GPT Copilot creates formulas faster than I can type them.” (G2, 2025)

Critical Review: “Great for basic data importing, but complex analysis still needs to be handled in native Sheets or Excel. I wish there was deeper analytics functionality.” (Rows, Dec 2024)

Support

Coefficient provides comprehensive support through help center documentation, email assistance, and live chat. Extensive onboarding guides and video walkthroughs help new users maximize their investment quickly.

MindBridge AI

Catch financial fraud before it costs you millions. MindBridge uses ensemble AI and unsupervised machine learning to analyze 100% of transactions in real-time. Trusted by global financial leaders for continuous risk monitoring.

Highlights of MindBridge AI

Automated fraud detection scans massive datasets to identify anomalies and financial errors instantly. LLM-enhanced mapping accelerates accounting data ingestion for scalable insights across large organizations.

Pros

Proactive risk management: Identify and act on financial risks in real-time instead of discovering problems during annual audits. This shifts your team from reactive to preventive.

Eliminates tedious work: Automates manual fraud detection and error checking, freeing specialists to focus on high-value strategic analysis. No more endless spreadsheet reviews.

Native Microsoft Fabric integration: Streamlines financial data consolidation across enterprise organizations. Works seamlessly with existing Microsoft infrastructure.

Cons

Steep learning curve: Traditional audit teams need significant training and cultural adaptation to fully leverage AI-driven processes. Change management becomes crucial.

Enterprise-focused pricing: Comprehensive features and scale make this solution potentially cost-prohibitive for smaller accounting firms with limited budgets.

Data dependency: Results quality directly correlates with data accuracy and completeness. Garbage in, garbage out still applies.

Pricing

As of August 2025, MindBridge offers customized enterprise pricing. Organizations must request demos for specific quotes. Standard subscriptions include all reporting and analytics features.

What do users say about MindBridge AI?

Positive Review: “MindBridge has completely transformed our audit process, offering insights that we couldn’t have found with manual review.” (Microsoft AppSource, Dec 2024)

Critical Review: “MindBridge is powerful, but transitioning from legacy methods was challenging, and our team needed significant upskilling to use it effectively.” (Q2 Update, June 2025)

Support

MindBridge delivers global support through helpdesk services, comprehensive documentation, training webinars, and expert consultant access. Resources cover onboarding, troubleshooting, and continuous skill development.

AppZen

Stop expense fraud before you pay. AppZen audits 100% of business expenses in real-time using AI-powered insights. Over 1,800 finance teams trust it for compliance monitoring and automated approvals.

Highlights of AppZen

Real-time expense auditing cross-references receipts, policies, and external data instantly. Automated compliance checks detect FCPA violations, anti-corruption issues, and healthcare professional restrictions before payment.

Pros

Prevents costly violations: Catches compliance issues and fraud before money leaves your accounts. This protects both your budget and legal standing.

Massive workload reduction: Automates approval for low-risk expenses while flagging only critical items for review. Finance teams report 70% time savings on expense processing.

Seamless integrations: Works out-of-the-box with SAP Concur and other major expense platforms. Implementation takes days, not months.

Cons

High entry barrier: Starting at $5,000 monthly makes this solution inaccessible for small businesses and startups with limited budgets.

False positive flags: AI occasionally marks legitimate expenses as suspicious, requiring manual review that defeats some automation benefits.

Setup requirements: Initial configuration and team training are necessary for optimal performance. Not quite plug-and-play.

Pricing

As of July 2024, AppZen starts at $5,000 per month with a free trial available for evaluation.

What do users say about AppZen?

Positive Review: “AppZen flags fraud and duplicate claims before we pay—major ROI and our audits are much more efficient.” (SelectHub Review, July 2024)

Critical Review: “It’s powerful, but the high price and occasional over-flags mean smaller companies may struggle to justify the cost.” (SelectHub Review, July 2024)

Support

AppZen offers 24/7 support including documentation, live chat, phone assistance, FAQ community forums, and training events for smooth onboarding and ongoing success.

DataSnipper

Turn Excel into an audit powerhouse. DataSnipper accelerates audit workflows through AI-powered document extraction and verification within Excel. Used by globally recognized firms for standardized audit procedures.

Highlights of DataSnipper

AI-powered document processing extracts, cross-references, and verifies audit evidence directly in Excel. GenAI DocuMine tool provides instant analysis of complex audit documents for faster evidence confirmation.

Pros

Eliminates repetitive work: Cuts time spent on audit documentation and matching tasks by automating them within familiar Excel environments. Hours become minutes.

Enhanced collaboration: Teams work from a single source of truth, improving accuracy and knowledge sharing across audit functions and entities.

Advanced AI analysis: DocuMine adds qualitative document analysis capabilities, reducing error rates while speeding evidence confirmation processes.

Cons

Excel dependency: All features require Excel, limiting usefulness for organizations using alternative spreadsheet platforms or cloud-only environments.

Learning curve required: Adopting AI features and GenAI tools requires team training and workflow adjustments. Not immediately intuitive for all users.

Limited mobile functionality: Best experience requires desktop Excel. Web and mobile support exists but lacks feature richness of the full platform.

Supercharge your spreadsheets with GPT-powered AI tools for building formulas, charts, pivots, SQL and more. Simple prompts for automatic generation.

Pricing

As of July 2025, DataSnipper offers freemium and paid subscription plans. Detailed pricing available upon request. Free trial currently available for evaluation.

What do users say about DataSnipper?

Positive Review: “DataSnipper has revolutionized our audit efficiency—what used to take days now takes hours.” (GetApp, July 2025)

Critical Review: “The Excel integration is great, but mobile/web features aren’t as robust; some complex workflows still need improvement.” (AppSource, May 2023)

Support

DataSnipper provides comprehensive support through documentation, webinars, email assistance, and live help. Thorough onboarding includes video walkthroughs and expert Q&A access.

Botsify

Automate customer interactions intelligently. Botsify creates AI-powered chatbots for websites, WhatsApp, Messenger, and more. No coding required—just drag-and-drop simplicity for lead generation and support automation.

Highlights of Botsify

Drag-and-drop chatbot builder with modular templates enables rapid deployment across multiple platforms. Multilingual support with agent fallback ensures seamless customer experiences globally.

Pros

Omnichannel engagement: Facilitates customer support across web, social media, and messaging platforms from a single interface. Consistent experience everywhere.

No technical skills needed: User-friendly interface lets non-technical team members build and deploy sophisticated chatbots without coding knowledge.

Performance analytics: Tracks conversion rates and service metrics, helping businesses optimize customer interactions and improve ROI continuously.

Cons

No free plan available: Only paid subscriptions after trial period, which may deter early-stage startups with tight budgets.

Scaling costs quickly: Advanced features and white-label options increase expenses rapidly for growing businesses with expanding needs.

Learning curve for advanced features: Enterprise deployments and complex automations require training and onboarding investment.

Pricing

As of June 2025, Botsify starts at $49/month for DIY plans, $149/month for ‘Done For You’ service, with custom pricing for enterprise and white-label solutions.

What do users say about Botsify?

Positive Review: “Botsify’s drag-and-drop builder made it easy to launch a multi-channel chatbot—excellent support and analytics.” (AIChief, June 2025)

Critical Review: “The absence of a free plan and rising costs for custom options make it less attractive for small businesses.” (Legitimate AI, July 2025)

Support

Botsify delivers dedicated support including live chat, comprehensive documentation, ticketing system, onboarding assistance, and analytics training. Enterprise plans include personalized onboarding and development support.

Gridlex

Replace multiple systems with one AI-driven platform. Gridlex combines accounting, ERP, payroll, inventory, and CRM into a comprehensive business solution. AI-powered analytics deliver actionable insights for optimizing profits and reducing costs.

Highlights of Gridlex

Integrated financial management covers accounting, payroll, inventory, and CRM in one platform. AI-driven reporting provides context-rich analytics with customizable, industry-specific chart of accounts.

Pros

Complete business solution: Eliminates the need for multiple software subscriptions by handling all financial operations in a single, integrated platform.

Smart analytics: AI-powered insights help optimize profits and reduce costs through data-driven recommendations and trend analysis.

Flexible access: Cloud-based platform works on desktop and mobile devices, providing secure access to financial data anywhere, anytime.

Cons

Complex implementation: Full setup and data migration often require professional assistance, especially for enterprise organizations with existing systems.

Pricing variations: Advanced modules and multi-entity support may require custom quotes or higher-tier plans that increase costs significantly.

Feature overwhelm: Comprehensive functionality can be overkill for small businesses with simple accounting needs who don’t require full ERP capabilities.

Pricing

As of August 2025, Gridlex starts at $10/user/month for Start plans, $30/user/month for Grow plans, with custom pricing for Scale enterprise solutions.

What do users say about Gridlex?

Positive Review: “Gridlex streamlined our accounting and ERP processes, and the AI-driven insights are incredibly useful for decision-makers.” (DynamicBusiness, 2025)

Critical Review: “Setup took time and required expert help, but once running, the reporting and support were solid.” (Gridlex, 2025)

Support

Gridlex offers expert onboarding, live chat, help desk services, and full implementation assistance. Support includes historical data management, comprehensive training, and ongoing troubleshooting for all subscription plans.

Ready to automate your accounting?

These AI tools are transforming how finance teams work. From catching fraud to automating reports, they’re eliminating manual tasks that drain productivity. Coefficient stands out for its seamless spreadsheet integration and zero learning curve. Want to see how AI can supercharge your financial workflows? Start your free trial today and discover what’s possible when your spreadsheets get smarter.