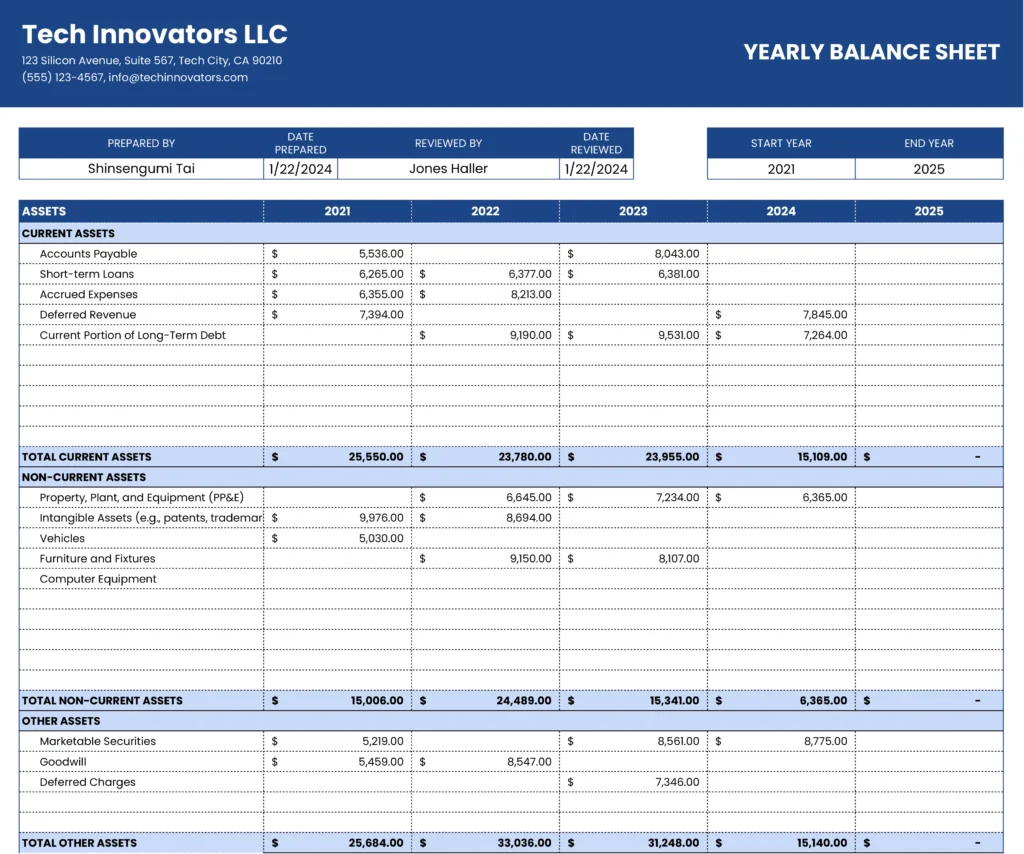

Managing a SaaS balance sheet requires precision. Complex accounting standards. Multiple revenue recognition rules.

Traditional balance sheets don’t capture the unique financial elements that define software companies. Deferred commissions, capitalized development costs, and stock-based compensation create reporting challenges that generic templates simply can’t handle.

Coefficient’s SaaS Balance Sheet Template solves this problem. Built specifically for software companies, it organizes your most critical financial metrics in a clean, professional format that scales with your business.

What is a SaaS balance sheet report?

A SaaS balance sheet report provides a snapshot of your software company’s financial position at a specific point in time. Unlike traditional balance sheets, it emphasizes metrics unique to subscription businesses.

Key differences matter. SaaS companies deal with deferred revenue from annual contracts, capitalized software development costs, and complex equity structures with multiple funding rounds. These elements require specialized tracking and presentation that standard accounting templates don’t provide.

The report helps investors, executives, and finance teams understand your company’s financial health through a SaaS-specific lens. It highlights growth investments, recurring revenue obligations, and equity dilution in ways that traditional financial statements often obscure.

Benefits of using our SaaS balance sheet template

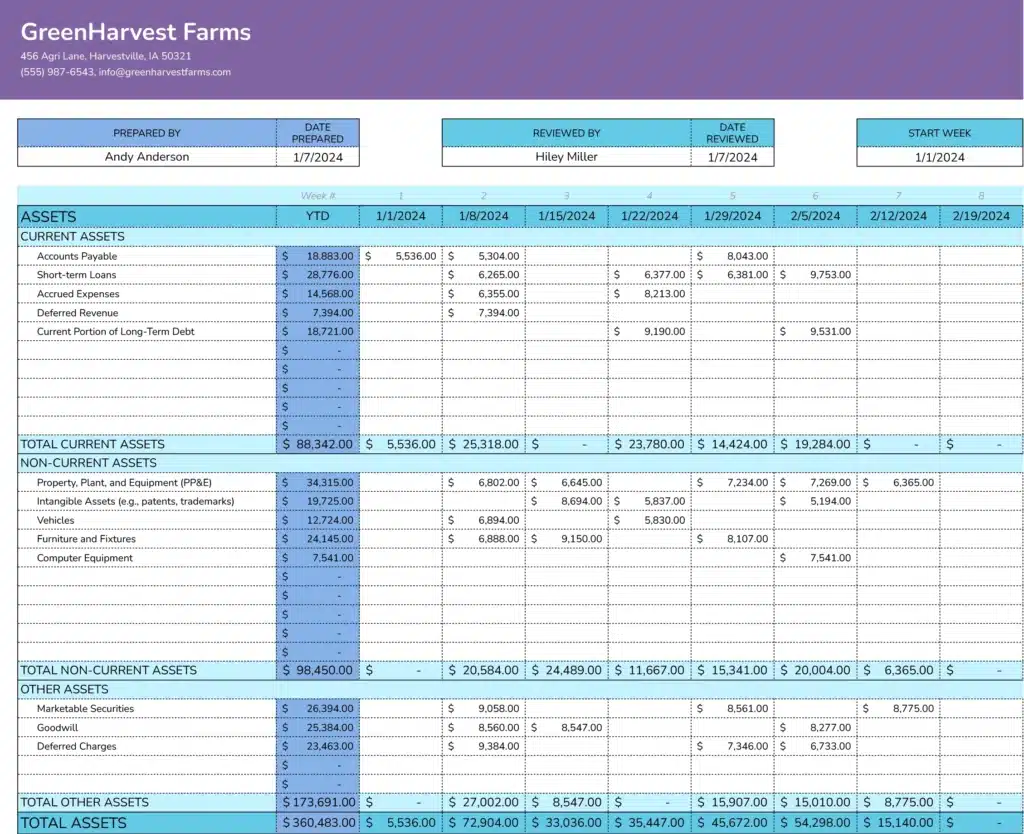

- Streamlined financial reporting. Our template organizes complex SaaS metrics into clear, logical sections. No more hunting through multiple spreadsheets or trying to adapt generic accounting templates to your unique business model.

- Investor-ready presentation. The format follows best practices that VCs and growth investors expect to see. Clean layouts, proper categorization, and industry-standard terminology make due diligence smoother and more professional.

- Comprehensive metric coverage. Track everything from deferred commissions to 409A valuations in one centralized location. The template includes sections for all major SaaS balance sheet components, eliminating the need to build custom tracking systems.

- Scalable structure. Whether you’re a seed-stage startup or a growth-stage company, the template adapts to your complexity level. Add new equity rounds, expand revenue categories, or include additional development cost buckets as your business evolves.

- Time-saving automation. Pre-built formulas and formatting reduce manual work. Spend less time on spreadsheet maintenance and more time on financial analysis and strategic planning.

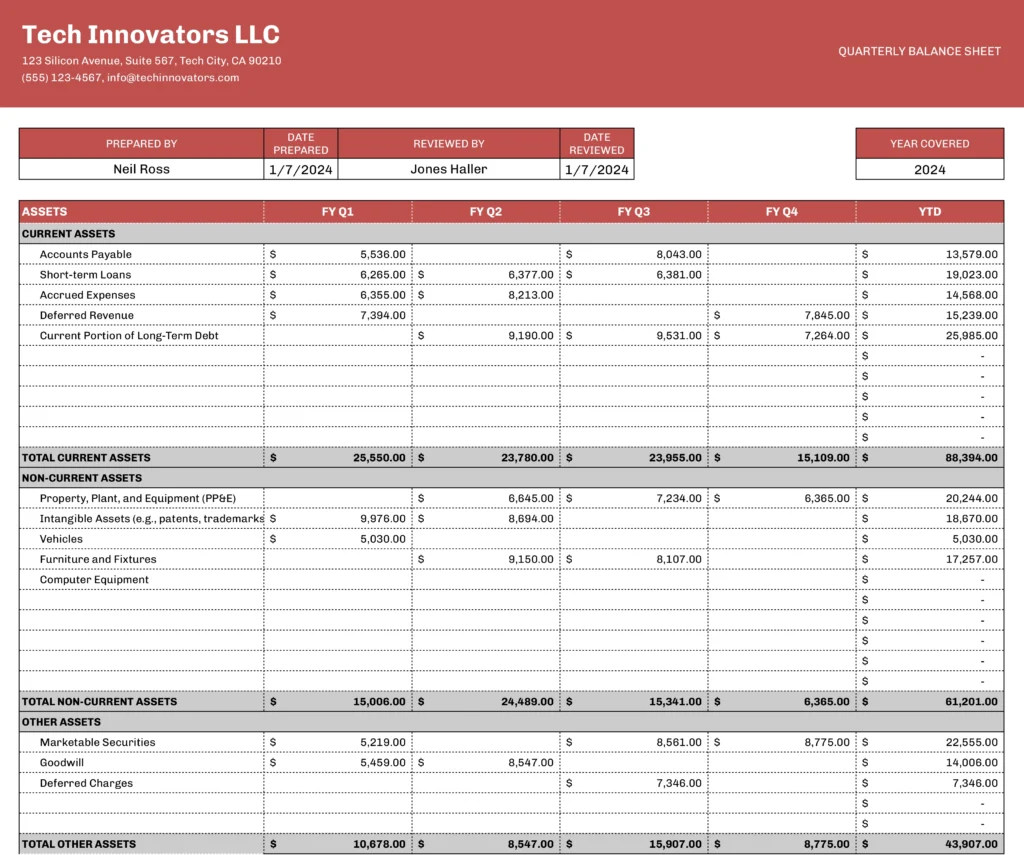

Metrics tracked in the report

Our SaaS Balance Sheet Template includes comprehensive tracking for the financial metrics that matter most to software companies:

Revenue and contract metrics:

- Deferred Revenue (by contract term)

- Contract Assets

- Contract Liabilities

- Subscription Refund Reserves

Development and commission costs:

- Deferred Commissions (by type)

- Capitalized Software Development Costs

Equity and compensation tracking:

- Stock-Based Compensation

- Employee Stock Options

- 409A Valuations

- Preferred Stock Liquidation Preferences

- Anti-dilution Provisions

Each metric includes proper categorization and formatting to ensure accurate financial reporting. The template provides space for detailed breakdowns while maintaining clean summary views for executive reporting.

Frequently asked questions

What makes a SaaS balance sheet different from a traditional balance sheet?

SaaS balance sheets emphasize subscription-specific metrics like deferred revenue and recurring billing obligations. They also highlight intangible assets like capitalized software development costs and complex equity structures common in venture-funded companies. Traditional balance sheets focus more on physical assets and straightforward debt structures.

How often should I update my SaaS balance sheet?

Most SaaS companies update their balance sheets monthly for internal reporting and quarterly for investor updates. The frequency depends on your growth stage, investor requirements, and internal planning cycles. Early-stage companies might update quarterly, while growth-stage companies typically need monthly updates.

What’s the difference between deferred revenue and contract liabilities?

Deferred revenue represents cash collected for services not yet delivered, while contract liabilities include both deferred revenue and other contractual obligations to customers. Contract liabilities provide a broader view of your future service obligations, including items like prepaid support or implementation services.

Start tracking your SaaS financials today

Managing SaaS financials doesn’t have to be complicated. Our template provides the structure you need to track critical metrics, satisfy investor requirements, and make better financial decisions.

Get your free template and start organizing your SaaS balance sheet data in minutes, not hours.